FEMA Letter of Map Amendment

Flood Map Research and LOMA Application ServiceFEMA Flood Insurance Rate Maps (FIRM)

- Floods occur naturally and can happen almost anywhere. They may not even be near a body of water, although river and coastal flooding are two of the most common types. Heavy rains, poor drainage, and even nearby construction projects can put you at risk for flood damage.

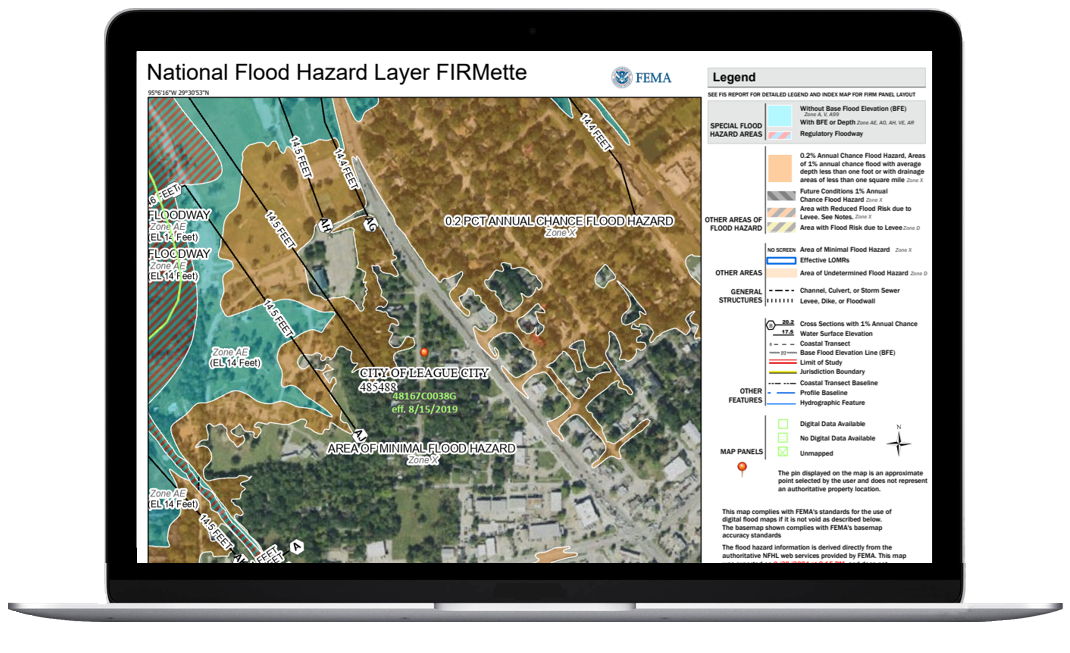

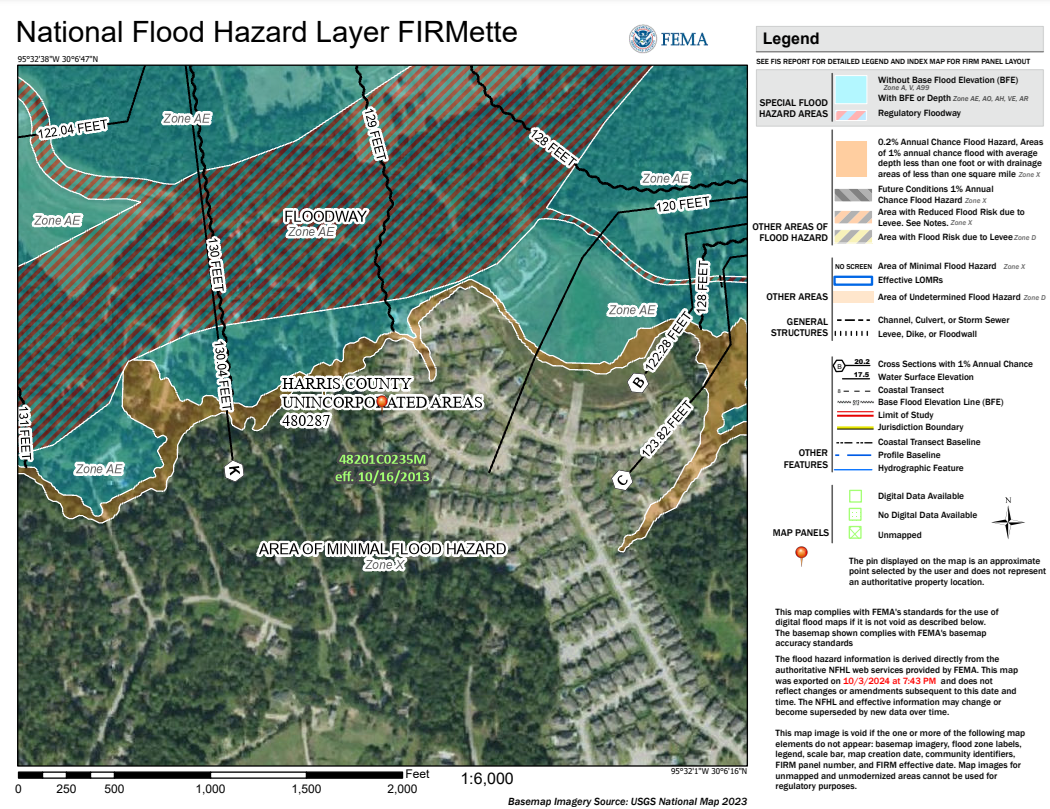

- The FEMA Flood Insurance Rate Maps show areas of high, moderate, and low flood risk as a series of zones. Each flood zone designation represented by a letter or letters, tells you what the risk is for flooding at your property.

- High-risk zones are called the Special Flood Hazard Areas (SFHAs) and begin with the letters “A” or “V.” Moderate- to low-risk zones, which are Non-Special Flood Hazard Areas (NSFHAs), begin with the letters “X”, “B” or “C.”

A FEMA FIRM shows how likely it is for an area to flood.

Any place with a 1% chance or higher chance of experiencing a flood each year is considered to have a high risk. Those areas have at least a one-in-four chance of flooding during a 30-year mortgage.

Reviewing your FIRM, you can see the relationship between your property and the areas with the highest risk of flooding.

FEMA Flood Insurance Rate Map

The FEMA Flood Insurance Rate Map (FIRM) is an essential tool that delineates flood hazard areas in your community.

It helps homeowners understand their flood risk and determine whether flood insurance is necessary. The map categorizes properties into different flood zones, each indicating a varying level of flood risk.

Request Current FIRM (Free)

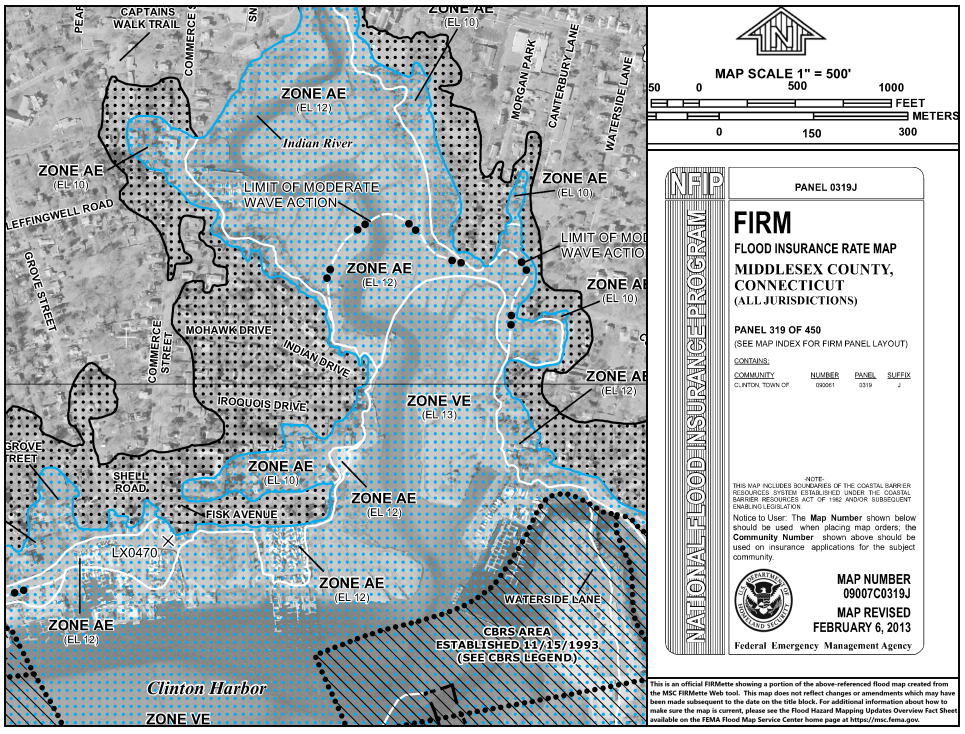

Understanding FEMA Flood Zones

- Zone A

- Description: This area is subject to inundation by the 1-percent annual chance flood (commonly referred to as the “100-year flood”). Flooding in Zone A is usually determined using approximate methodologies.

- Implications: Properties in Zone A are typically required to have flood insurance, as they face a significant risk of flooding.

- Zone X

- Description: Zone X is classified as an area of minimal or moderate flood risk. This zone is typically outside the 1-percent annual chance floodplain.

- Implications: While flood insurance is not mandatory for properties in Zone X, homeowners are still encouraged to consider coverage, as flooding can occur even in low-risk areas.

Other Common Zones:

Zone V

- Description: Areas at risk of coastal flooding with additional hazards, like wave action.

Zone AE

- Description: Similar to Zone A, but with base flood elevations provided.

Why This Matters: Understanding your property’s flood zone is crucial for assessing flood risk and making informed decisions about flood insurance and preparedness. The FIRM is a vital resource for homeowners, ensuring they are aware of their flood risk and can take appropriate action.