Letter of Map Amendment

FEMA Flood Map Research and LOMA Application ServiceChange Your Flood Zone Designation

Think your home doesn’t belong in a FEMA-designated flood zone? We can help prove it — and potentially save you thousands.

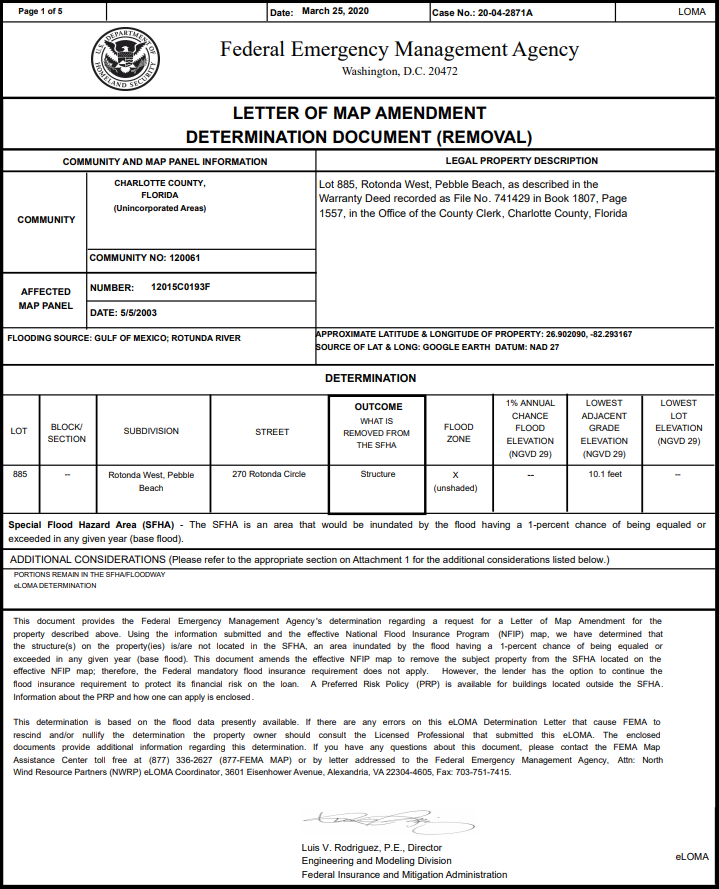

If your property has been placed in a high-risk flood zone like Zone A or Zone AE, but you believe it’s on naturally high ground, you may qualify for a Letter of Map Amendment (LOMA). This is an official FEMA document that can remove your home from the Special Flood Hazard Area (SFHA) — and eliminate the requirement to carry costly flood insurance.

What Is a LOMA?

A Letter of Map Amendment is issued by FEMA to verify that your structure is not at risk of base flood inundation, based on its elevation. In other words, it shows that your home sits above the Base Flood Elevation (BFE), even if the flood map says otherwise.

What You Need:

To request a LOMA, property owners must provide technical documentation — usually including an Elevation Certificate prepared by a licensed surveyor or engineer. Once FEMA reviews and approves the data, they issue a determination confirming whether the structure can be removed from the flood zone.

Why It Matters:

-

✅ Stop Paying for Flood Insurance: If FEMA grants your LOMA and your lender agrees, you can cancel your policy and even receive a refund for the current term.

-

✅ Increase Property Value: Homes outside the flood zone are more attractive to buyers and lenders.

-

✅ Peace of Mind: Get official confirmation that your property is not at high risk for flooding.

Let Us Handle the Hard Part

The LOMA process can be technical, time-consuming, and frustrating. We simplify it for you.

-

We evaluate your property to see if you qualify.

-

We gather and submit all documentation to FEMA on your behalf.

-

We follow up until a final determination is issued.

-

We help you communicate with your lender to remove the flood insurance requirement.

Don’t Go Through FEMA Alone

We’ve helped countless homeowners successfully remove their properties from flood zones — and we can help you, too.

Start with a free consultation to see if you qualify.